We lead, we strive for greatness, we are CFOs. No matter how well off your company is, at Hilb Group of New England – Merrimack, formerly known as Clark & Lavey, we know that there is always room for improvement and self-reflection. This starts with strong leadership and a cohesive team. As a C-level leader, you are a leader that your team looks to for guidance and support. Learn how we can help support you in your role as a CFO or CEO by improving your company health insurance plan to help you meet your financial goals.

Improve Your Company Health Insurance Plan

Captive insurance is a company health insurance program that provides coverage for, and is controlled by, its owners. Captive programs can be formed by a single company or by groups of companies and associations. Through Hilb’s InCap health care captive program, we have seen companies realize savings of 12% – 15% in the first year. Besides cost savings, our company health program helps lower health premium costs while also providing:

- Control of your plan’s benefits design

- Avoidance of unanticipated rate increases

- Transparency in data, cost, and communications

- No burdensome plan negotiation

- Pooling of claims to control volatility and cash flow

- Retention of underwriting profit and investment income

$10,509,695

New Distribution of Profits from Pool

15.4% Profit Share

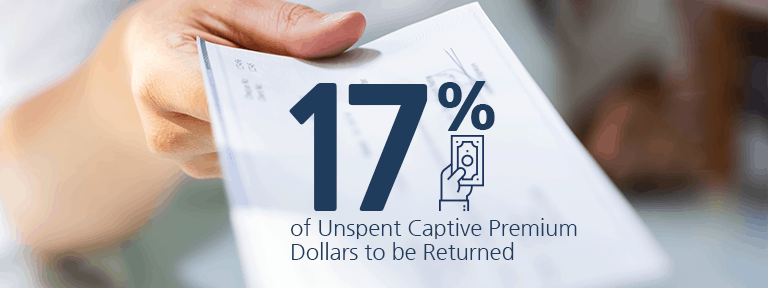

of Unspent Captive Premium Dollars to be Returned

$70 Million

Total Claim Cost Savings Since Inception

$758,995

Average Per Year in Annual PBM Rebates

Improve Cash Flow with InCap®, our Captive Insurance Program

As a CEO or CFO, you understand the benefit of additional cash flow. Through Hilb’s InCap® health care captive program, you will gain an additional means of cash flow. InCap works differently than fully-insured plans from insurance carriers who keep the plan’s annual profit. Instead, InCap members receive the annual profit from unused claims, which you’d then be able to use for other areas of your business. Click here to learn how much profit we’ve distributed through our InCap program.

Already in a Captive Program?

If you are already a member of a captive program, consider the benefits that InCap may provide over your current company health insurance plan. First of all, what is your captive’s retention level? We place 69% percent of the stop-loss premium in the captive, which has a retention of $500,000. This is significantly higher than other captive plans and may be higher than your current captive plan. Additionally, does your captive plan take expenses out of the shared layer? Because InCap does not!

Frequently Asked Questions

Testimonials

"We have been with Clark & Lavey's InCap since 2015. The cost-savings have been invaluable along with having full control of the benefit plans. Spending time understanding these plans has allowed me to not only work closely with the CFO and finance team but also assist with new initiatives. And unlike with fully funded insurance plan, we don't have to wait for renewal to fix an issue for our employees. With the support of our Benefits Advisor Al Carlson, we can actually step in and help. It is just one more way to showcase that we care. Al helps me in any way he can including negotiating admin rates for voluntary insurances like short-term disability."

Ballentine Partners, LLC

Brie Elliot, Director of Human Resources

"If you have financial stability, there is no other plan you should do. It is the right thing for your company and employees. Clark & Lavey has helped us reduce a significant amount of cost. We can control expenses while also providing quality products to employees. The flexibility in the product lets us analyze and look at trends to make educated decisions. For example, we joined a PBM to save on prescription costs and provided information regarding urgent care to save on ER costs."

Pierce Aluminum

Peter Langton, Vice President of Human Resources

"Our Benefits Advisor, Noreen Chick, is always there for us and thoroughly explains all the data to us so we can truly understand it. For example, we noticed that some of our employees were using the ER for issues that could be resolved with telehealth. We were able to provide educational resources regarding telehealth and saw a decrease in emergency room visits. As a partially self-funded institution, Noreen has supplied us with the data so we can truly see the difference between the costs for fully funded compared to self-funded. Even their HR Practice Leader, Jennifer Hayes, helps out with legal advice to save costs when we meet with attorneys so we can ask the right questions. We have saved tens if not a hundred thousand or more with Clark & Lavey, and those savings can be passed down to employees."

Gann Academy

Cheryl George, Director of Human Resources

"Clark & Lavey saves us thousands of dollars each year by being a part of the InCap captive, but saving money is only one of the perks to this partnership. I have a team of experts who are only a phone call or email away. Navigating the ever-changing world of health benefits can be daunting, but Noreen Chick has been an invaluable resource who works to keep everything running smoothly by providing notices of impending deadlines, offering vital advice, and presenting practical solutions to issues that might arise. Clark & Lavey’s high-level HR professionals provide excellent services such as how to approach a difficult employee relation issue or reviewing employee handbook updates which, makes my job so much easier. I am lucky to have such a wonderful working relationship with Clark & Lavey and team."

InCap Client

"Not only were we well protected and provided the best health insurance for our business – every option was exhausted to best meet our needs – but to have the deep bench of experts to lend support for our business, was an enormous benefit. With today’s HR folks taking on more compliance and risk issues, it was a great comfort to have the knowledge and resources behind us. When our company was acquired, benefits were taken over by the corporate office and I was sorry our partnership ended."

The Paciello Group

Debra A. Rapsis, Partner, Internal Operations

"Clark & Lavey makes it easy for you. They are incredibly passionate and bring everything to the table to help you save costs. From assisting with analyzing reports and high costs claims or their accurate forecasts. We started as fully funded and transitioned to InCap in 2015 and have saved over 1.5 million since. Besides the cost-savings, service matters, values matter, and so do our employee's health. Through their wellness programs, employees were able to stop smoking and improve their overall well-being."

Triangle Credit Union

Karin Taylor, PHR, SHRM-CP, Senior Vice President Human Resources

“We have found Clark and Lavey to be exceptionally professional, thorough and –above all – extremely responsive and helpful both with respect to our health and welfare plans and the general HR insight and support they provide. They are ALWAYS “there” when we need them! We value their input and advice and they are one of our most trusted business partners. Thank you to everyone at Clark and Lavey!”

One Sky Community Services

Chris Muns, Chief Executive Officer

Have a Question?

Discover the Hilb Group Difference

Benefits

Tailored benefits that meet your needs, and service that exceeds your expectations. We provide optimal, cost-effective solutions that deliver long-term value.

Captives

InCap®, Hilb Group’s captive is a proven solution to controlling escalating health premiums. It offers the control of self-funding, but with greater stability.

HR Support

Whether it’s day-to-day issues, strategic planning, or anything in between, our extensive HR services and Practice Leader are here with help and support when you need it most.

Discover the Hilb Group Difference

Benefits

Tailored benefits that meet your needs, and service that exceeds your expectations. We provide optimal, cost-effective solutions that deliver long-term value.

Captives

InCap®, Hilb’s group captive is a proven solution to controlling escalating health premiums. It offers the control of self-funding, but with greater stability.

HR Support

Whether it’s day-to-day issues, strategic planning, or anything in between, our extensive HR services and Practice Leader are here with help and support when you need it most.