Legal Alert – November 11, 2021

On November 10, 2021, the Internal Revenue Service (IRS) released Revenue Procedure 2021-45, which increases the health flexible spending account (FSA) salary reduction contribution limit from 2021 to $2,850 for plan years beginning in 2022, an increase of $100 from 2021. Thus, for health FSAs with a carryover feature, the maximum carryover amount is $570 (20% of the $2,850 salary reduction limit) for plan years beginning or ending in 2022.

The Revenue Procedure also contains the cost-of-living adjustments that apply to dollar limitations in certain sections of the Internal Revenue Code.

Qualified Commuter Parking and Mass Transit Pass Monthly Limit

For 2022, the monthly limits for qualified parking and mass transit are increased to $280 each, an increase of $10 from 2021.

Adoption Assistance Tax Credit Increase

For 2022, the credit allowed for adoption of a child is $14,890 (up $450 from 2021). The credit begins to phase out for taxpayers with modified adjusted gross income in excess of $223,410 (up $6,750 from 2021) and is completely phased out for taxpayers with modified adjusted gross income of $263,410 or more (up $6,750 from 2021).

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) Increase

For 2022, reimbursements under a QSEHRA cannot exceed $5,450 (single) / $11,050 (family), an increase of $150 (single) / $350 (family) from 2021.

Reminder: 2022 HSA Contribution Limits and HDHP Deductible and Out-of-Pocket Limits

Earlier this year, the IRS announced the inflation adjusted amounts for HSAs and high deductible health plans (HDHPs).

The ACA’s out-of-pocket limits for in-network essential health benefits have also increased for 2022. Note that all non-grandfathered group health plans must contain an embedded individual out-of-pocket limit if the family out-of-pocket limit is above $8,700 (2022 plan years). Exceptions to the ACA’s out-of-pocket limit rule are also available for certain small group plans eligible for transition relief (referred to as “Grandmothered” plans). Unless extended, relief for Grandmothered plans ends December 31, 2022.

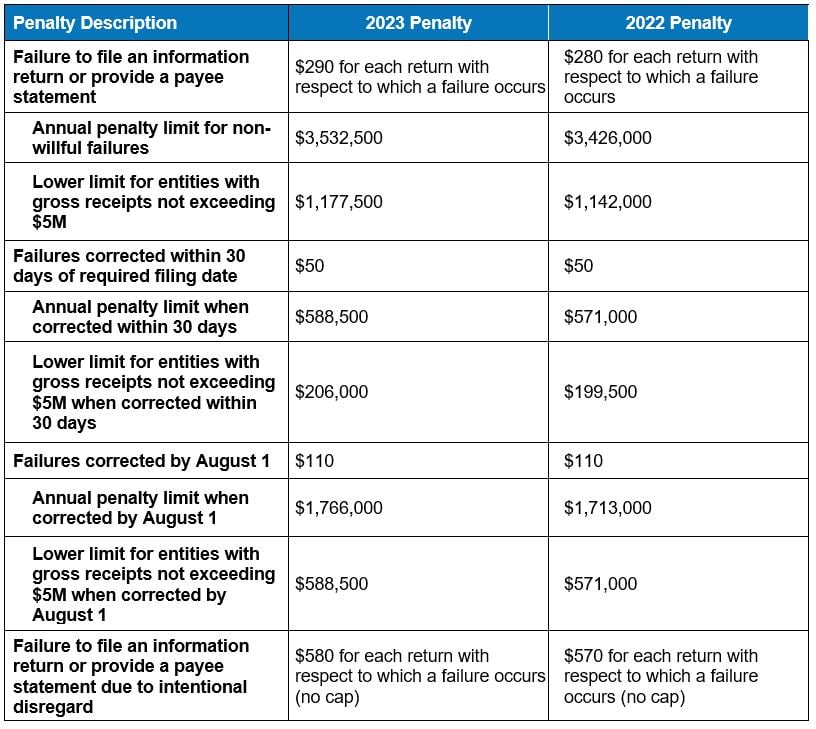

ACA Reporting Penalties (Forms 1094-B, 1095-B, 1094-C, 1095-C)

The table below describes late filing penalties for ACA reporting. The 2023 penalty is for returns filed in 2023 for calendar year 2022, and the 2022 penalty is for returns filed in 2022 for calendar year 2021. Note that failure to issue a Form 1095-C when required may result in two penalties, as the IRS and the employee are each entitled to receive a copy.

About the Authors. This alert was prepared for Clark & Lavey Benefits Solutions by Marathas Barrow Weatherhead Lent LLP, a national law firm with recognized experts on the Affordable Care Act. Contact Stacy Barrow or Nicole Quinn-Gato at [email protected] or [email protected].

About the Authors. This alert was prepared for Clark & Lavey Benefits Solutions by Marathas Barrow Weatherhead Lent LLP, a national law firm with recognized experts on the Affordable Care Act. Contact Stacy Barrow or Nicole Quinn-Gato at [email protected] or [email protected].